How to Avoid Costly Importer Liability with Product Insurance

- By Grace

- Updated on

The email arrives on a Tuesday morning. It's from a law firm you've never heard of, representing a customer you've never met. The subject line is blunt: "Product Injury Claim." Suddenly, the success of your best-selling massager is overshadowed by the terrifying possibility of a lawsuit—a legal battle that could drain your resources, tarnish your brand, and threaten the very existence of your business.

This isn't a movie plot. It's the single greatest unmanaged risk for any importer of consumer electronics and a critical part of business risk management. Even with the most obsessive quality control, accidents can happen. And in a market like Australia and the world, where the law says the importer is legally the manufacturer, that risk falls squarely on your shoulders. Trusting a supplier who just says, "don't worry, our products are safe," is a reckless gamble.

At KLCOSY, we believe a true partnership is built on shared risk and mutual protection. It requires a financial fortress, a pre-emptive shield that protects your business from the catastrophic "what ifs." This is the role of comprehensive product liability insurance. Let's pull back the curtain on what this protection really means for your business and why it's a non-negotiable pillar of secure supply chain risk management.

So, Why is 'Trust Us, It's Safe' a Reckless Gamble?

Every product you sell is a promise to your customer—a promise of quality, performance, and above all, safety. But in the real world of global manufacturing, a verbal promise is not enough. You need a legally and financially binding guarantee to ensure true brand protection.

The reality is, even the best products can be involved in unforeseen incidents. I remember an online retailer telling us that our comprehensive insurance policy was the deciding factor for them. It wasn't just about the product's features; it was about knowing they had a partner who had their back if the worst-case scenario ever happened. It turned an abstract risk into a managed, predictable part of their business.

The Legal Reality: The 'deemed manufacturer'

The Australian Consumer Law (ACL) has a critical rule that directly impacts you. If the overseas manufacturer (that's us) doesn't have a registered office in Australia, the law legally makes *your business* the manufacturer. This is the concept of the "deemed manufacturer," and it means you are the primary target in any product-related lawsuit, responsible for all damages. This legal reality makes our product liability insurance not just a benefit for us, but a direct and essential shield for you.

Key Takeaway: Under Australian law, you as the importer are legally considered the manufacturer. A supplier's product liability insurance is one of the only ways to financially protect yourself from this inherited risk.

Our Global Shield: Explicit Coverage for the Australian Market

Here’s a scary thought: a global insurance policy with a fine-print exclusion for your sales territory. It's worse than no policy at all, providing a false sense of security. The single most important question you can ask a supplier is not "Do you have insurance?" but "Does that policy explicitly and unequivocally cover my sales in Australia?"

It’s a question we at KLCOSY love to answer because our answer is a simple, powerful "Yes." I recall a distributor who was getting ready for a major launch in Sydney. They asked for our certificate early in their due diligence. Seeing "Australia" explicitly named as a covered territory was the final green light their board needed for a major capital investment.

Our commitment to you is global in scope but specific in its application. We intentionally structured our insurance to provide comprehensive, worldwide coverage that explicitly includes Australia and New Zealand. We understand the unique legal landscape and the "deemed manufacturer" clause, and our policy is crafted to directly address this importer liability.

Unpacking Our Policy: The Certificate of Insurance

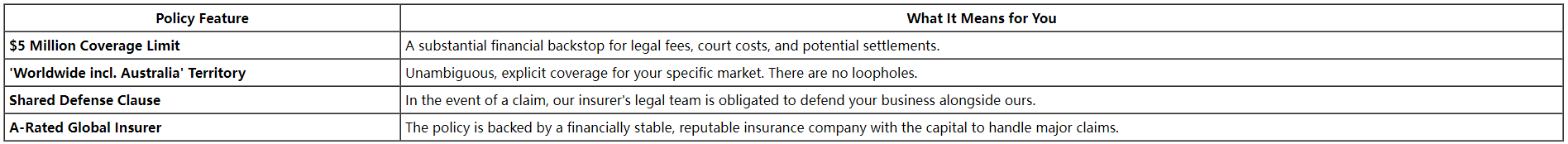

We believe in total transparency. We will provide any serious partner with a copy of our current Certificate of Insurance. This is the official, verifiable proof of our coverage. It clearly outlines the key details, allowing you to confirm that our coverage meets your risk management standards.

Key Takeaway: Verifiable insurance isn't just a promise; it's a document. A true partner provides a Certificate of Insurance that explicitly names your sales territory and has a substantial coverage limit.

What's This Going to Cost Me? The Economics of Financial Assurance

You see the value, you understand the protection. But the final, critical question remains: "Is this essential protection an expensive add-on? A hidden fee that's going to pop up on my final invoice?"

The CFO of a national retail chain told us our straightforward pricing model, with insurance costs already factored in, made their financial forecasting simple and predictable. There were no hidden "risk premiums" or surcharges, allowing them to calculate their true landed cost with total certainty.

Our philosophy at KLCOSY is that safety and security are not optional extras; they are a core, non-negotiable part of the product itself. The cost of our comprehensive product liability insurance is already factored into our standard unit pricing. There are no surprise fees or "insurance surcharges."

As a large-scale manufacturer, we're able to secure a global policy at a far more competitive premium than any single importer could. We leverage our volume to negotiate favorable terms, and we pass that advantage on to you in the form of an all-inclusive, highly competitive unit price. Ultimately, our insurance is a form of capital protection for your business, ensuring that a single, unpredictable event cannot jeopardize the brand you've worked so hard to build.